A stock is a type of investment that represents an ownership share in a company. Investors buy stocks that they think will go up in value over time.

Definition

A stock is a security that represents a fractional ownership in a company. When you buy a company’s stock, you’re purchasing a small piece of that company, called a share.

Investors purchase stocks in companies they think will go up in value. If that happens, the company’s profit increases in value as well. The stock can then be sold for a profit.

When you own stock in a company, you are called a shareholder because you share in the company’s profits.

How does it work

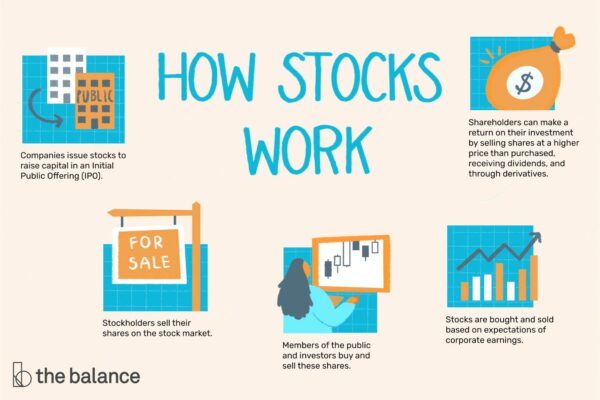

Public companies sell their stock through a stock market exchange, like the Nasdaq or the New York Stock Exchange. (Here’s more about the basics of the stock market.) For companies, issuing can be a way to raise money to pay off debt, launch new products, or expand their operations, according to the SEC.

For investors, investing in stocks is a way to grow your money and outpace inflation over time. When you’re a shareholder, you can make money when prices rise, you may earn dividends when the company distributes earnings, and some shareholders can vote at shareholder meetings.

Investors can buy and sell shares through stockbrokers. The exchanges track the supply and demand of each company’s, which directly affects the stock’s price.

» Learn more: Read our detailed tutorial on how to buy stocks.

Stock prices fluctuate throughout the day, but investors who own it hope that over time, it will increase in value. Not every company or stock does so, however: Companies can lose value or go out of business completely. When that happens, investors may lose all or part of their investment. That’s why it’s important for investors to diversify. A good rule of thumb is to spread your money spread their money around, buying stock in many different companies rather than focusing on just one.

If you have a 401(k), you probably already own stock, though you might not realize it. Most employer-sponsored retirement plans invest in mutual funds, which can hold a large number of company stocks pooled together.

» Dive deeper: How to diversify your investment portfolio

How to make money

Stocks carry more risk than some other investments, but also have the potential to reap higher rewards. Stock investors earn money in two main ways:

-

If the price of a stock goes up during the time you own it, and you sell it for more than you paid for it.

-

Through dividends. Dividends are regular payments to shareholders. Not all stocks pay dividends, but those that do typically do so on a quarterly basis.

» Interested in dividend income? View our list of high-dividend stocks.

Over the last century, the market has posted an average annual return of 10%. The word “average” is important here: Not only is that return an average for the market as a whole — rather than a specific individual stock — but in any given year, the market’s return can be lower or higher than 10%. for more details.

You can buy individual stocks through an online broker. The process of opening a brokerage account is similar to opening a bank account. The commissions charged by online brokers for trades vary, so it’s important to shop around. See NerdWallet’s picks for the best brokers for stock investors for more details.

Key things to know about stocks

Common stocks vs. preferred stocks

There are two main types of stocks: common and preferred. The main differences between common and preferred stock are dividends and voting rights. Most investors own common in a public company. Common may pay dividends, but dividends are not guaranteed, and the amount of the dividend is not fixed. Investors of common typically have voting rights that are proportional to their ownership level.

Preferred stocks typically pay fixed dividends, so owners can count on a set amount of income from the stock each year. Owners of preferred also stand at the front of the line when it comes to the company’s earnings: Excess cash distributed by dividend is paid to preferred shareholders first, and if the company goes bankrupt, preferred-stock owners receive any liquidation of assets before common-stock owners. Owners of preferred stock usually do not have voting rights.

Read our full explainer on the types of stocks for more detail.

Trading vs. investing

Traders buy and sell to get a short-term profit. Investors buy and hold stocks, and usually do better over the long term. Investors typically own a diversified portfolio of many stocks, and hold on to them through good economic times and bad. (Here’s more on the differences between stock trading and investing.)

Individual vs. funds

Investing in individual stocks takes time. You should research each stock you purchase, which includes a deep dive into the bones of the company and its financials. Many investors opt to save time by investing in stocks through equity mutual funds, index funds and ETFs instead. These allow you to purchase many stocks in a single transaction, offering instant diversification and reducing the amount of legwork it takes to invest.